Moving Averages Indicator (MA, EMA, SMA) On Tradingview The problem with using this indicator is that it doesn’t offer any predictive power for future stock trends. Traders using Moving Averages can observe the overall trend rather than focusing on individual data points. Traders will buy when the moving average crosses over the current trading price, and they will sell when it falls below it.

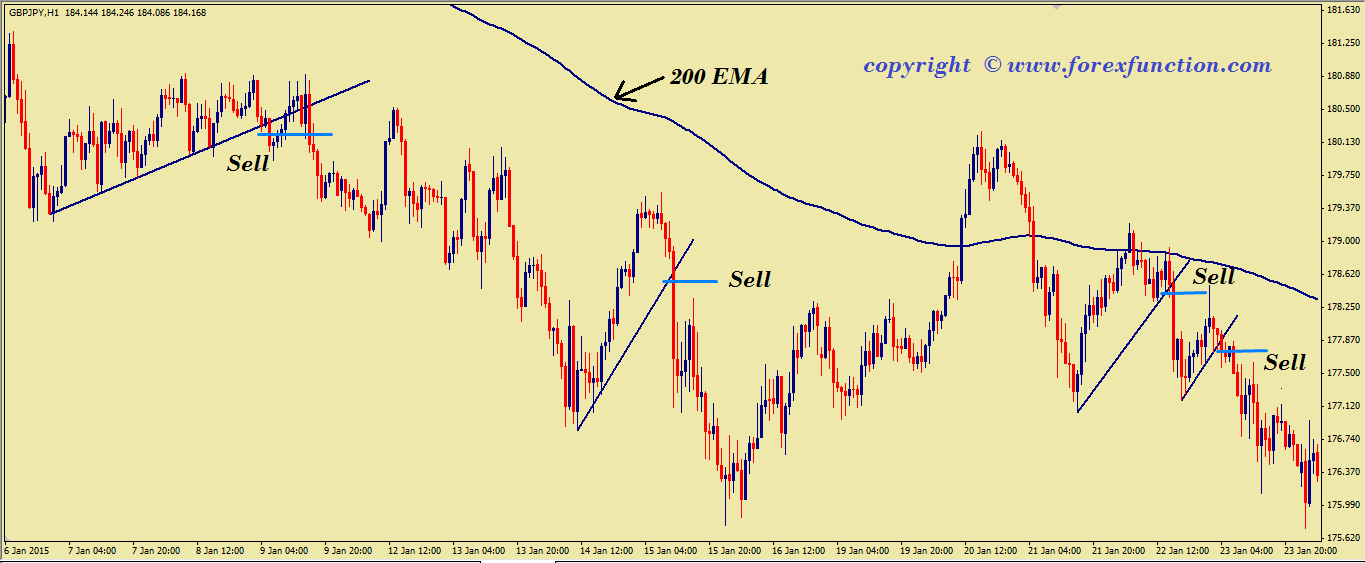

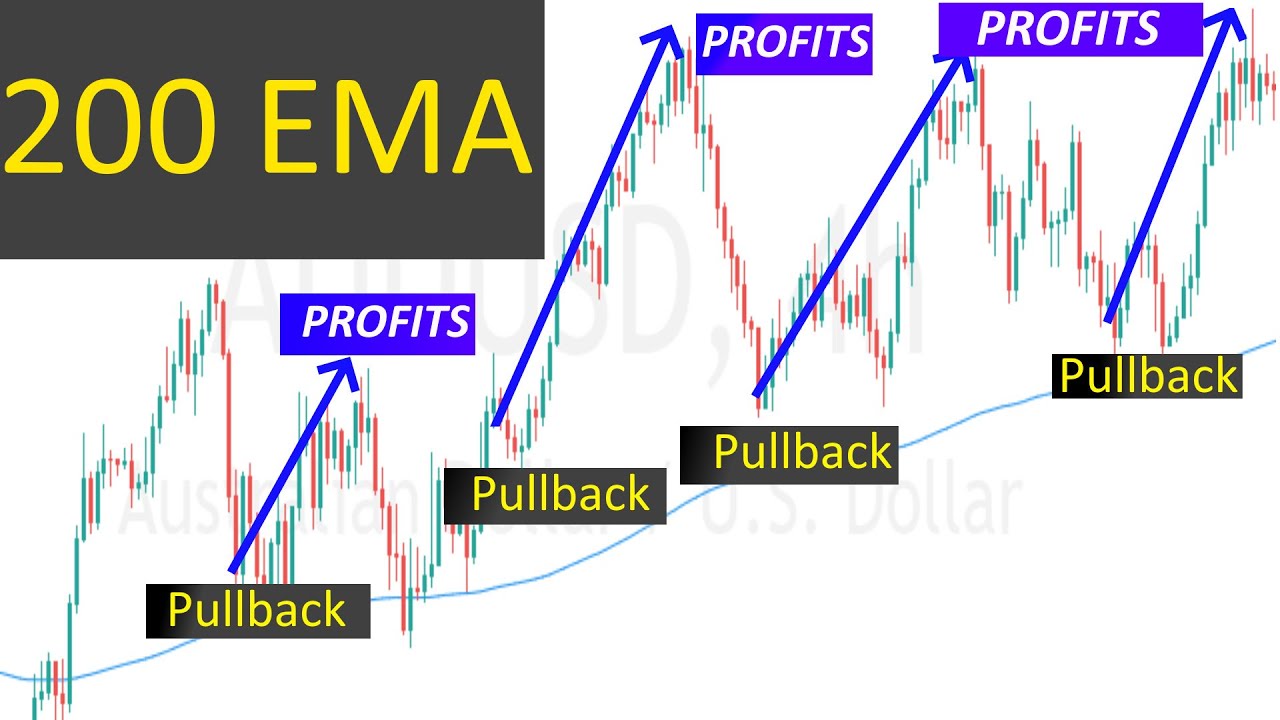

Many traders believe that this indicator accurately represents the actual direction in which the trend is headed. The Moving Average Indicator is a graphical representation of the average price for a specific timeframe. A moving average, or “moving mean,” is the average of any data points over an arbitrary number of periods. They are commonly used on stock prices and can be applied across multiple timeframes and stock charts. Moving averages are a popular tool to help remove some noise in measuring trends changes. When the short-term MA crosses above the longer-term MA, it can signal an uptrend in price movement.Ĭonversely, when the short-term MA crosses below the longer-term MA, it signals a downtrend in price movement. It is calculated by adding the latest price to the previous period’s average and dividing by 2. The moving average is a technique that removes the effect of volatility in price data. Best Moving Averages For Different Time-Frame Chartsĩ Key Takeaways Trading Moving Averages Suggested Moving Averages (Subjective / Varies) Day Trading.Whether Or Not This Indicator Is Reliable.Most Important Moving Averages For Stocks.In the trading world, many traders rely on their indicators to forecast price movements. They are the difference between the current price and the price at a specified number of periods ago.Ī trader may use moving averages to identify trends, provide signals for buy or sell, or assist in determining low-risk entries into trades.Ī trader will often change the time they are averaging, leading to different results. Moving averages are one of the most straightforward trading strategies to understand. The 20-day average is called a short-term moving average.Ī 50-day moving average is considered to be in the medium term.Ī 200-day moving average is considered long-term. The most common are 8-day, 20-day, 50-day, 100-day, and 200-day averages. The moving average of a stock is the stock’s average price over several periods. There are three types of moving averages: simple, exponential, and weighted. Moving averages are a primary technical analysis tool that provides a clearer picture of the market trend.

200 SMA VS 200 EMA FREE

Thank you! - Please don't forget to signup to our free email newsletter. Your support helps us grow our Website, which allows us to continue providing you useful information. This post may also contain affiliate links and I may earn a small commission when you click on the links at no additional cost.

200 SMA VS 200 EMA PROFESSIONAL

You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on our Website and wish to rely upon, whether to make investment decisions or otherwise. It is very important to do your own analysis before making any investment based on your personal circumstances. Our content is intended to be used and must be used for informational purposes only. Disclaimer: Before using this site, please make sure that you note the following important information.

0 kommentar(er)

0 kommentar(er)